Larry Fink’s New Love Letter to Asset Tokenization

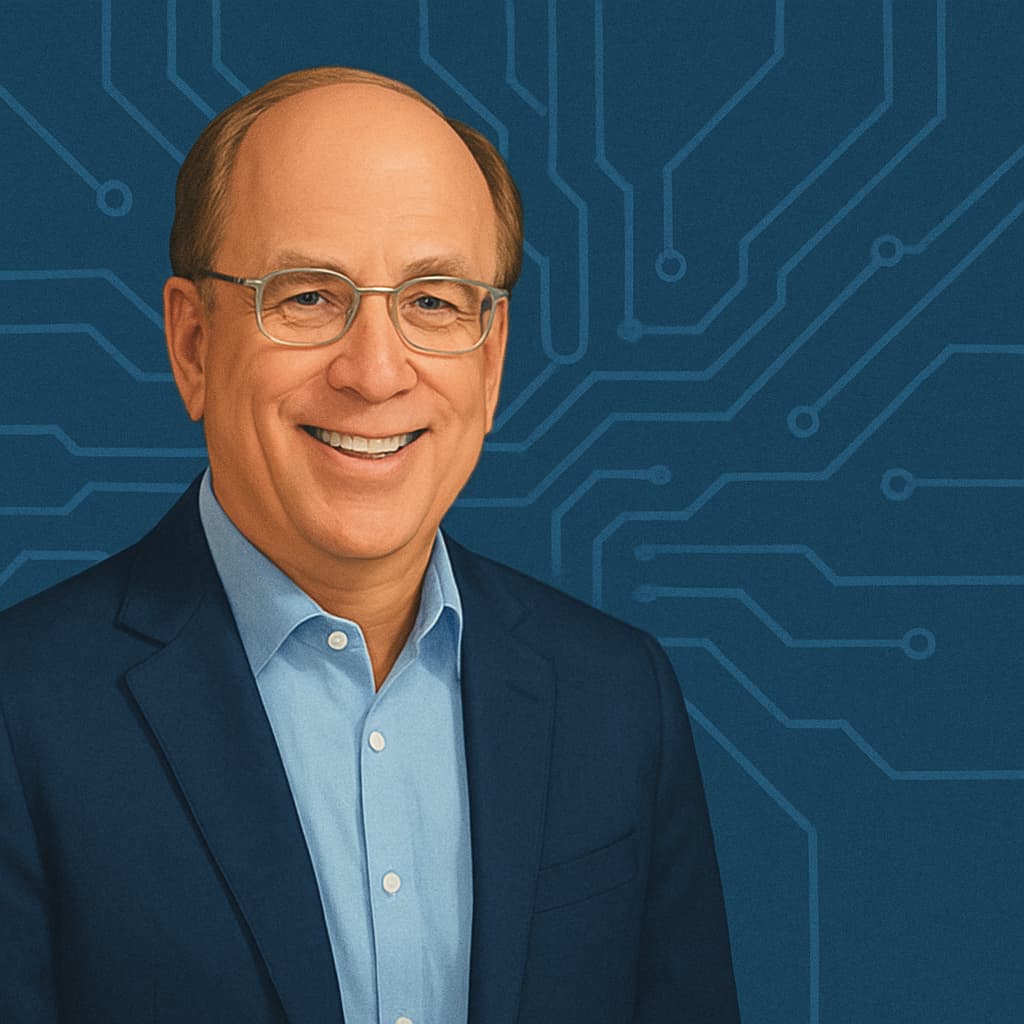

When the CEO of the world’s largest asset manager doubles down on a technology, markets listen. That is exactly what happened with Larry Fink’s latest essay on tokenization, co-authored with BlackRock COO Rob Goldstein for The Economist, where they argue that digital ledgers can transform the plumbing of global finance.

This is only the last of Fink's statements promoting asset tokenization, which include mentions in two of his annual letters to investors.

A New Stage in the Evolution of Market Plumbing

Fink and Goldstein frame tokenization as the next step in a decades-long modernization of market infrastructure: from physical share certificates moved by courier, to SWIFT messages in the 1970s, to today’s millisecond trading between New York and London. The new leap, in their view, is recording ownership directly on blockchains — “digital ledgers” that any participant in the network can verify.

This shift allows almost any asset class, from real estate to corporate debt, to live on a single shared record instead of across fragmented, incompatible systems. In practical terms, it means fewer reconciliation headaches, fewer intermediaries, and cleaner data about who owns what, and when.

Instant Settlement and Modernized Private Markets

They highlight two core promises of tokenization. First, instant or near-instant settlement. Today, different markets still settle on different timelines — often T+2 in listed equities and longer in some fixed-income and private assets. Those lags introduce counterparty risk: the possibility that one side fails to deliver cash or securities on time. If tokenized markets converge on real-time settlement, that risk shrinks and capital is freed up more quickly.

Second, they emphasize the potential to drag private markets out of the paper era. Large, illiquid holdings such as real estate, infrastructure, and private credit are still managed with manual processes and bespoke contracts. Encoding rights and cash flows into tokens could make these assets cheaper to administer, easier to fractionalize, and ultimately more accessible to a wider set of investors.

Global Adoption and the “1996 Internet” Moment

The essay also underlines how geographically asymmetric the early wave of adoption already is. While American and European institutions built much of the traditional financial infrastructure, many early users of tokenized assets are outside the West, in markets where banking access is limited and digital rails can leapfrog legacy systems.

To explain where we are in the cycle, Fink reaches for an internet analogy. Tokenization today, he suggests, looks like the web in 1996: Amazon was still a small online bookstore, and several of today’s largest tech companies did not yet exist. In that sense, the current tokenized asset landscape — tiny relative to global equity and bond markets but already growing at triple-digit rates — could be the early stage of something that compounds over decades.

Building a Bridge Between TradFi and Digital Assets

Crucially, Fink does not predict that tokenization will overthrow the existing system. Instead, he describes a bridge being built from both sides of the river: on one bank, traditional institutions and regulated markets; on the other, digital-first innovators such as public blockchains, fintechs, and stable-value payment rails.

Over time, he envisions a world where investors do not think in terms of “traditional” versus “crypto” portfolios at all — just a single digital wallet holding many types of assets, governed by consistent rules and interoperable infrastructure.

Building Trust

That vision brings him to regulators. Fink’s message is pragmatic: there is no need for an entirely new rulebook. Instead, existing regulations should be adapted so tokenized and traditional markets can interoperate safely. A bond is still a bond, even if it “lives” on a blockchain. What matters is how risk is managed: clear investor protections, robust counterparty-risk standards, and strong digital identity and KYC so that participants can trade on-chain with the same confidence they have when swiping a card or wiring funds.

Tokenization is not just about making markets faster and cheaper; it is about doing so while building trust, so that capital markets — “the world’s most powerful engine of wealth creation,” in his words — can reach the most people.

Read the article.

Enter the new tokenized economy

Token City is the ultimate bridge to the tokenized economy (tEconomy), in which tokenized companies (tEnterprises) create their cryptoasset markets (tMarkets), open to global investors (tCitizens).